Instructions for the Nebraska W-2 File Creator

This Nebraska W-2 File Creator spreadsheet is used by employers that do not have software to create a file in the required ![]() 21EFW2 format.

21EFW2 format.

Follow these steps to use the Nebraska W-2 File Creator spreadsheet.

- To download the spreadsheet, right-click on the link, W2_NE_Report.xlsm, select "Save Target As" (or "Save Link As" in some browsers), and choose a location to save the file.

- Using Excel, open the file from the location where you saved it. NOTE: For Excel 2003 only, you must install the Compatibility Pack from Microsoft to open and use this spreadsheet. Click here for more information.

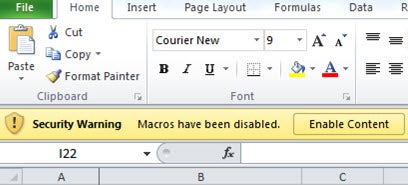

- Enable macros. When opening the spreadsheet, you may see the Security Warning shown below. If you see this message, you must click "Enable Content." Once you have done that, you can begin using the spreadsheet. NOTE: If you do not see the Security Warning, you already have macros enabled and can begin using the spreadsheet.

- Enter employer information. This includes the following fields:

- Federal ID Number

- Employer Name

- Nebraska Withholding Account # (a valid Nebraska withholding account number must be entered – do not enter "21-" prefix in your state ID # field)

- Payment Year

- Employer's Address, City, State, and Zip Code

- Enter your employees' W-2 with Nebraska income information into the spreadsheet. All fields are required, except for Employee Middle Name/Initial. NOTE: If you paste information into the fields that exceed the maximum length, an error message will be shown when you click the "Create File" button. Maximum number of characters are:

- Last Name – 20

- First Name – 15

- Middle Name/Initial – 15

- Address – 22

- City – 22

- State – 2

- Verify the totals in Row 5 are correct when you have entered all of the employees' W-2s.

- Click the "Create File" button. This saves the spreadsheet and creates the file that will be uploaded. When the file is created, you will receive a message with the location of your "W2_NE_Report.txt" file. This is the file you will upload to the Department's website. NOTE: If changes are needed after the file is created, you must close and reopen the spreadsheet.

- By following the steps below, upload the W2_NE_Report.txt file that was created. NOTE: Do not upload W2_NE_Report.xlsm.

- Go to the https://ndr-efs.ne.gov/revefs/allPages/login.faces.

- Log in with your State ID number and PIN.

- Complete all of the required fields (Contact Information – first name, last name, phone number, and email).

- Click "Upload W2/1099 Data."

- Click the "Select File to Attach" button.

- Browse to the folder where the W2_NE_Report.txt file was saved.

- Click on "W2_NE_Report.txt."

- Click "Open."

- If errors appear during the upload, re-open the spreadsheet and fix the errors. Then click the Create File button and upload the new file.

- After the "Files Attached for Submission" section shows that it is verifying the file, click on the "Submit" button. You must submit the file and receive a reference number before your information will be processed by the Nebraska Department of Revenue.

Do not send in paper copies of your Wage and Tax Statements, Forms W-2, to the Nebraska Department of Revenue if you electronically filed the Forms W-2 as described above and received a reference number.