Closing Your Business in Nebraska

This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. A guidance document does not include internal procedural documents that only affect the internal operations of the DOR and does not impose additional requirements or penalties on regulated parties or include confidential information or rules and regulations made in accordance with the Administrative Procedure Act. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document.

This guidance document may change with updated information or added examples. DOR recommends you do not print this document. Instead, sign up for the subscription service at revenue.nebraska.gov to get updates on your topics of interest.

![]() Nebraska Change Request, Form 22, is used to cancel any or all of the following tax programs:

Nebraska Change Request, Form 22, is used to cancel any or all of the following tax programs:

- Corporation Income Tax

- Fiduciary Income Tax

- Financial Institution Tax

- Income Tax Withholding

- Litter Fee

- Lodging Tax

- Partnership Income Tax

- Sales Tax

- Severance & Conservation Tax

- Tire Fee

- Tobacco Products Tax

- Unstamped Cigarette Transporter

- Use Tax

- Waste Reduction & Recycling Fee

- Wholesale Cigarette Dealer

You are required to file tax returns for all tax periods through the date of your last transaction or last wage payment. You must file a final return if you:

- Cease business operations;

- Sell, transfer, or assign your business; or

- Change the form of your business (for example, from a sole proprietorship to a corporation), which requires registration of the new entity.

A final return must be filed within 20 days after you cease business operations or the sale, transfer, or change occurs.

Employers who cancel their income tax withholding account within 30 days after discontinuing business must file a final ![]() Nebraska Reconciliation of Income Tax Withheld, Form W-3N, and attach the state copy of each

Nebraska Reconciliation of Income Tax Withheld, Form W-3N, and attach the state copy of each ![]() Federal Form W-2, Wage and Tax Statement, that was issued to each employee.

Federal Form W-2, Wage and Tax Statement, that was issued to each employee.

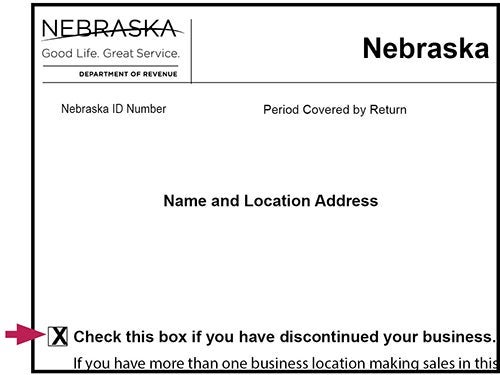

You can also cancel your business license by checking the box on your final return. If you are licensed for more than one tax program, you will need to check this box on EACH final return.

Purchasers of an existing business beware – You could be buying a debt to the Nebraska Department of Revenue! When purchasing an existing business, or assets of an existing business, you may be held liable for unpaid taxes owed by the business to the Department at the time of sale.

Even if the purchase contract includes a statement that the seller’s business is free and clear of all encumbrances, the buyer must verify that there is no tax due with the Department. A certificate of clearance can be obtained by filing a ![]() Tax Clearance Application, Form 36, with the Department.

Tax Clearance Application, Form 36, with the Department.

Send Form 36 to:

State of Nebraska

Department of Revenue

Compliance Division

PO Box 94609

Lincoln NE 68509-4609

If tax is owed, you must withhold and remit to the Department enough money from the purchase price to ensure that taxes, penalties, and any accrued interest owed to the Department by the previous business have been paid. Failure to withhold these taxes, penalties, and any accrued interest from the purchase price means the purchaser is personally liable as the successor for any sales or use taxes due, or as the transferee for any income taxes due (including employee income tax withholding). See See Neb. Rev. Stat. §§ 77-2707 and 77-27,110.

For more information, see ![]() REG-1-073, Discontinuation of Business , or the information guide "

REG-1-073, Discontinuation of Business , or the information guide "![]() Statutory Responsibilities for Collecting, Reporting, and Remitting Nebraska Taxes."

Statutory Responsibilities for Collecting, Reporting, and Remitting Nebraska Taxes."

Additional information regarding closing your business may be found here:

Nebraska One-Stop Business Registration Information System

Nebraska Department of Economic Development Business Toolkit

Nebraska Department of Labor (402-471-9933)

Workers' Compensation Court (402-471-6468)

Nebraska Secretary of State for registering a business, trade name, and Occupation Tax (402-471-4079)