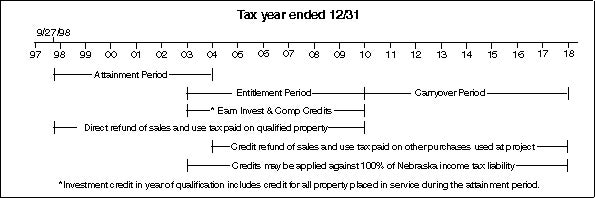

Employment & Investment Growth Act Benefits and Sample Timelines

Facts

- Application filed September 27, 1998.

- Application filed for a $3,000,000 and 30 employee project for a new manufacturing facility.

- Applicant has a December 31 federal tax year end. There are no short tax years.

- Applicant reaches the $3,000,000 and 30 employee level in tax year end December 31, 2004.

- The taxpayer maintained the required levels of employment and investment for the entitlement period

Base year

- (1/1/97 - 12/31/97)

Direct refunds

- (9/27/98 - 12/31/10)

Attainment period

- (9/27/98 - 12/31/04)

- Maximum Allowable Time

Credit refunds (must be sufficient credits from prior year)

- (1/1/05 - 12/31/18)

Entitlement period

(1/1/04 - 12/31/10)

Credit use for income tax (must be sufficient credits at end of year)

- (1/1/04 - 12/31/18)

Carryover period

- (1/1/11 - 12/31/18)

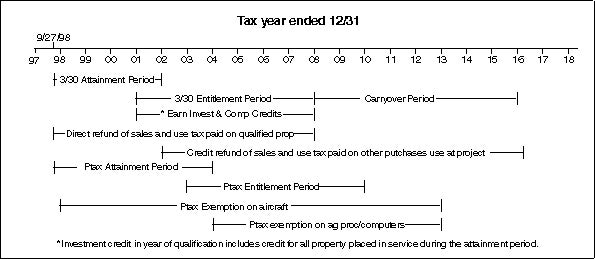

Facts:

- Application filed September 27, 1998.

- Application filed for a $10,000,000 and 100 employee project for a new manufacturing facility.

- Applicant has a December 31 federal tax year end. There are no short tax years.

- Applicant reaches the $3,000,000 and 30 employee level in tax year end December 31, 2002.

- Applicant reaches the $10,000,000 and 100 employee level in tax year end December 31, 2004.

- The taxpayer maintained the required levels of employment and investment for the entitlement periods

Base year

- (1/1/97 - 12/31/97)

Direct refunds

- (9/27/98 - 12/31/08)

Attainment period

- (9/27/98 - 12/31/03)

- Maximum allowable time

Credit refunds (must be sufficient credits from prior year)

- (1/1/04 - 12/31/16)

Entitlement period

- (1/1/03 - 12/31/08)

Credit use for income tax (must be sufficient credits at end of year)

- (1/1/03 - 12/31/16)

Carryover period

- (1/1/09 - 12/31/16)

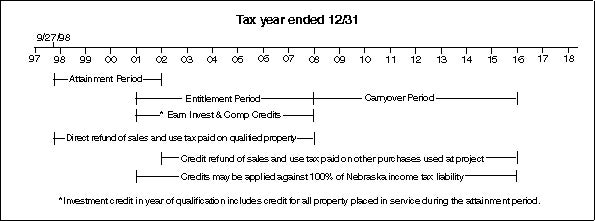

Facts:

- Application filed September 27, 1998.

- Application filed for a $3,000,000 and 30 employee project for a new manufacturing facility.

- Applicant has a December 31 federal tax year end. There are no short tax years.

- Applicant reaches the $3,000,000 and 30 employee level in tax year end December 31, 2002.

- The taxpayer maintained the required levels of employment and investment for the entitlement period.

Base year

- (1/1/97 - 12/31/97)

Direct refunds

- (9/27/98 - 12/31/08)

Attainment period

- (9/27/98 - 12/31/02)

Credit refunds (must be sufficient credits from prior year)

- (1/1/03 - 12/31/16)

Entitlement period

- (1/1/02 - 12/31/08)

Credit use for income tax (must be sufficient credits at end of year)

- (1/1/02 - 12/31/16)

Carryover period

- (1/1/09 - 12/31/16)

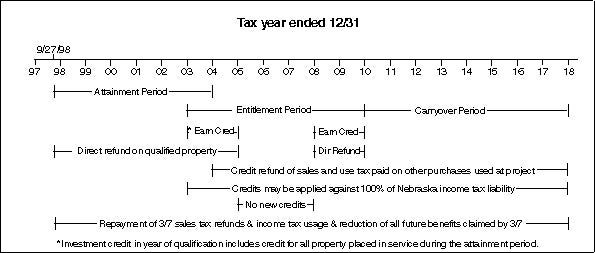

Facts:

- Application filed September 27, 1998.

- Application filed for a $3,000,000 and 30 employee project for a new manufacturing facility.

- Applicant has a December 31 federal tax year end. There are no short tax years.

- Applicant reaches the $3,000,000 and 30 employee level in tax year end December 31, 2004.

- The taxpayer was in recapture for tax years ending December 31, 2006 through December 31, 2008.

Base year

- (1/1/97 - 12/31/97)

Direct refunds

- (9/27/98 - 12/31/05 & 1/1/09 - 12/31/10)

Attainment period

- (9/27/98 - 12/31/04)

Credit refunds (must be sufficient credits from prior year)

- (1/1/05 - 12/31/18)

Entitlement period

- (1/1/04 - 12/31/10)

Credit use for income tax (must be sufficient credits at end of year)

- (1/1/04 - 12/31/18)

Carryover period

- (1/1/11 - 12/31/18)

Period not eligible for new credits

- 1/1/06 - 12/31/08

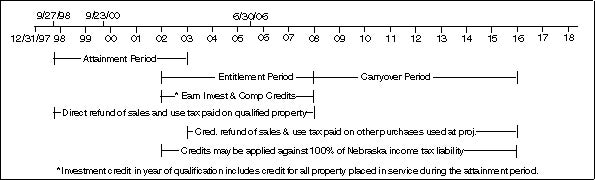

Facts:

- Application filed September 27, 1998.

- Application filed for a $3,000,000 and 30 employee project for a new manufacturing facility.

- Applicant has a December 31 federal tax year end. The taxpayer has short tax years ending 9/23/00, 12/31/00, 6/30/06 and 12/31/06.

- Applicant reaches the $3,000,000 and 30 employee level in tax year end December 31, 2003.

- The taxpayer maintained the required levels of employment and investment for the entitlement period.

Base year

- (1/1/97 - 12/31/97)

Direct refunds

- (9/27/98 - 12/31/08)

Attainment period

- (9/27/98 - 12/31/03)

- Maximum allowable time

Credit refunds (must be sufficient credits from prior year)

- (1/1/04 - 12/31/16)

Entitlement period

- (1/1/03 - 12/31/08)

Credit use for income tax (must be sufficient credits at end of year)

- (1/1/03 - 12/31/16)

Carryover period

- (1/1/09 - 12/31/16)