Microenterprise Tax Credit Guide

This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. A guidance document does not include internal procedural documents that only affect the internal operations of DOR and does not impose additional requirements or penalties on regulated parties or include confidential information or rules and regulations made in accordance with the Administrative Procedure Act. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document.

This guidance document may change with updated information or added examples. DOR recommends you do not print this document. Instead, sign up for the subscription service at revenue.nebraska.gov to get updates on your topics of interest.

Introduction

The Nebraska Advantage Microenterprise Tax Credit Act (Act) provides a refundable individual income tax credit to individual applicants who are actively involved in operating a microbusiness based on demonstrated growth of the business over two years.

- An individual must submit a Nebraska Advantage Microenterprise Tax Credit Application (application) to reserve credits.

- The Act allows the Nebraska Department of Revenue (DOR) to authorize tax credits in the amount of $2 million each calendar year, plus any unclaimed credits carried forward from the prior year.

- The applicant may earn a credit equal to 20% of the increase in new investment or new employment at the microbusiness in the year of application and the year after application.

- The total lifetime tax credits claimed by any single applicant and any related persons are limited to $20,000. The $20,000 lifetime limit applies to both the individual and the microbusiness.

- The applicant may file a subsequent application after the first two-year application period has ended. The applicant may claim no more than the difference between the $20,000 lifetime limit and the amount previously claimed plus any pending amount currently reserved for the applicant or a related person.

- If the growth in the microbusiness is intended to benefit more than one individual actively involved in the microbusiness, each individual should submit a separate application, reference the other individual that has applied for the same microbusiness when completing the application, and split the estimated amounts of new investment and new employment accordingly.

I. Eligibility Requirements

The Act requires that the following eligibility requirements be met at the time of application:

- Active Involvement

- The individual applying must be actively engaged in the operation of the microbusiness with personal involvement on a daily basis in the management and operation of the microbusiness. Any individual for whom the microbusiness is considered a passive activity for federal income tax purposes is not actively engaged in the operation of the microbusiness.

- Number of Full-time Equivalent Employees

- The microbusiness cannot exceed five full-time equivalent (FTE) employees at the time of application. DOR requires that the applicant provide documentation to show the total hours paid for the most recently completed pay period when the application is submitted. DOR may request payroll registers for additional periods.

Note: The number of full-time equivalent employees does not equal the number of individuals employed in many cases. A part-time employee equals less than one equivalent employee. An employee who worked overtime may equal more than one equivalent employee.

- The microbusiness cannot exceed five full-time equivalent (FTE) employees at the time of application. DOR requires that the applicant provide documentation to show the total hours paid for the most recently completed pay period when the application is submitted. DOR may request payroll registers for additional periods.

- Farmers and Livestock Operators

- An application will not be accepted from an individual actively engaged in the operation of a farm or livestock operation with a net worth of more than $500,000, including any holdings by a spouse or dependent, based on fair market value. A microbusiness involved in the following activities is not subject to the $500,000 limitation for farm and livestock operations: processing or marketing of agricultural products raised by another person; aquaculture; agricultural tourism; or producing fruits, herbs, tree products, vegetables, tree nuts, dried fruits, organic crops, or nursery crops.

- Applicants Who are Dependent upon Another Person to Conduct the Business

- An applicant who is required to hold a license to conduct the microbusiness and that license is controlled by another person, or is dependent on supervision by some principal, will not be considered to be operating a separate microbusiness and cannot qualify for credits under the Act. The applicant will be considered an employee of the principal. If the principal meets the requirements for the microenterprise tax credit, an application could be filed by a person actively engaged in the operation of the principal. See GIL 29-17-1 for additional information.

- E-Verify

- A microbusiness under the Act must use E-Verify, a federal electronic verification program, to ensure that Nebraska employees hired after the date of application are legally able to work in Nebraska. An applicant must provide proof of registration with E-Verify at the time of application. Benefits will not be granted unless the applicant can prove that the work eligibility status of all newly hired employees employed in Nebraska has been electronically verified in a timely manner. All hours worked by, and compensation paid to, an employee who is not timely confirmed as eligible to work in Nebraska will be excluded from the calculation of any tax incentive for all periods. See Revenue Ruling 29-13-3.

II. Completing the Application. Establishing an Application Date

An individual must file the application and all items in Part 1 of the application must be properly completed. If any of these items are omitted or are incomplete, the application date will be adjusted to the date on which the last of these items is received.

The application date will determine the base year used for employment and investment calculations. The date of a completed application will be used to determine the priority for the authorization of the project’s expected benefits. There is at least $2 million available for each calendar year through 2032.

If more than one complete application is filed on the day in which the cumulative expected benefits for the year exceed the amount of funds available, the remaining available funds will be prorated among the applicants on that day.

Any application filed after November 1 will be treated as an application filed on the first business day of the following calendar year.

Part 1 - Application

Employees

Item 1

The number of people currently employed is a head count of individuals on the current payroll of the microbusiness.

Item 2

The number of FTE employees is computed by dividing the total hours paid in a year by the product of 40 times the number of weeks in a year. For example, if the number of hours paid in a year is 4000 and the year consisted of 52 weeks, the microbusiness would have 1.9 FTEs (4000/2080). As an initial test of the number of FTE employees, DOR will require documentation showing the total hours paid during the most recent pay period. DOR may request payroll records for additional periods on the results of the initial test.

The number of FTE employees does not equal the number of people actually employed in many cases.

Item 3

All applicants under the Act are required to use E-Verify, a federal electronic verification program, to ensure that employees hired to work in Nebraska after the date of application are legally able to work in Nebraska. If the microbusiness currently does not have employees, and does not plan to have employees in the future, the applicant is not required to use E-Verify, and may skip Item 3 and go on to Item 4.

To receive compensation credits under this program, the applicant must provide evidence that the microbusiness has timely verified the work eligibility status of all Nebraska employees hired after the application date.

Business Activity and Structure

Item 4

Identify if the taxpayer or microbusiness meets the definition of a foreign adversarial company owned is in whole or in part, operated, or controlled by the government of a foreign adversary. Foreign adversarial companies are ineligible to receive or apply for this Nebraska tax incentive.

Item 5

Provide a description of the microbusiness. Include a description of the types of activities the microbusiness is engaged in, including the types of products sold and the markets served.

Item 6

Describe the current entity type, organizational structure, and/or ownership of the microbusiness in the current year and check the entity type under which the applicant plans to file the microbusiness’ income tax return.

Item 7

Identify the microbusiness's tax year end. If this does not agree with the tax return, provide an explanation.

Item 8

A change in the ownership of a microbusiness or a change in its entity type, does not create a new microbusiness for purposes of computing incentive credits. The investment and compensation of the microbusiness, regardless of the ownership or entity type, must be used in calculating employment and investment in the base year, the year of application, and the year after application.

- Example 1

- Converting a business from a sole proprietorship to an S corporation changes the employment status of the owner, but a comparable compensation figure must be recorded in the base yearand each year used to calculate employment growth.

- Example 2

- Acquiring an ongoing business is treated as though the buyer owned the business during the base year and all periods up to the date of purchase. Refer to GIL 29-17-3.

- The compensation and employer cost of health insurance paid by the previous owner of the acquired business must be included in the base year, and all periods up to the date of purchase.

- The value assigned to assets acquired as part of the purchase of the ongoing business will not be included as new investment.

- The microbusiness’s investment by the previous owner of the acquired business (including asset purchases, leases, repairs, advertising, legal, and professional services) must be included in the base year investment, and all periods up to the date of purchase.

- Acquiring an ongoing business is treated as though the buyer owned the business during the base year and all periods up to the date of purchase. Refer to GIL 29-17-3.

The applicant must document the investment and compensation by providing substantiating records. The types of records that may be provided include copies of the following items:

- The prior business’s federal income tax return(s), if available;

- The Nebraska Reconciliation of Withholding, Form W-3N, with attached Federal Forms W-2. If the buyer is a successor, a copy of this document may be requested from DOR by completing the Nebraska Tax Return Copy Request, Form 23;

- Other types of records that would normally be a part of a sale of a business, such as purchase documents, financial records, personnel records, and asset ledgers; and

- Property tax filings from the county assessor.

DOR will only approve credits to the extent the applicant substantiates new investment or employment growth by producing evidence that it exceeds investment or employment of the prior business's activity during the base year.

Expansion

Item 9

The narrative response to Item 9 should explain, in detail, the estimated figures provided in Table 14. The narrative must include an explanation of the expected increases in investment and compensation.

Item 10

To be eligible to reserve tax incentive credits, the applicant must demonstrate not only that he or she will make new investment or employment in the microbusiness, but also that the new investment or employment will create new income or jobs in the area.

Personal Involvement

Items 11 and 12

The applicant must be actively engaged in the operation of the microbusiness. Active engagement requires personal involvement on a continuous basis in the daily management and operation of the microbusiness. Any individual for whom the microbusiness is considered a passive activity for federal income tax purposes is not actively engaged in the operation of the microbusiness. Explain the nature and significance of your involvement in the microbusiness. Specify the frequency of your involvement, including the number of hours per week you are engaged in the operation of the microbusiness.

Estimated Credit

Item 13

The applicant must provide information on any related person who has applied for tax incentive credits under the Act. The estimated microenterprise tax credits are subject to a lifetime limit of $20,000 for an applicant and any related persons. The $20,000 lifetime limit applies to both the individual and the microbusiness applying. You may wish to consult with business partners and other related persons before you submit an application because confidentiality rules may prevent DOR from disclosing information about other taxpayers to you. If a related person has previously reserved credits under this program, the applicant may reserve credits in an amount equal to or less than the difference between $20,000 and the credits reserved by the related party. If the full amount of credits you request is not available due to the reservation of credits by a related person, DOR will issue a notice indicating the amount of credits that remain available to you. Due to confidentiality rules, DOR will not be able to disclose which related person or persons previously reserved credits under the program. "Related persons" is defined in Neb. Rev. Stat. § 77-5903(6) to include:

- Any corporation, partnership, limited liability company, cooperative, including cooperatives exempt under section 521 of the Internal Revenue Code of 1986, as amended, limited cooperative association, or joint venture which is or would otherwise be a member of the same unitary group, if incorporated.

- An individual and a corporation if more than 50% in value of the outstanding stock of the corporation is owned, directly or indirectly, by or for the individual.

- A fiduciary of a trust and a corporation if more than 50% in value of the outstanding stock of the corporation is owned, directly or indirectly, by or for the trust or by or for a person who is a grantor of the trust.

- A corporation and a partnership if the same persons own:

- more than 50% in value of the outstanding stock of the corporation and

- more than 50% of the capital interest, or the profits interest, in the partnership,

- A subchapter S corporation and another subchapter S corporation if the same persons own more than 50% in value of the outstanding stock of each corporation.

- A subchapter S corporation and a C corporation if the same persons own more than 50% in value of the outstanding stock of each corporation.

- A partnership and a person owning, directly or indirectly, more than 50%of the capital interest, or the profits interest, in the partnership.

- Two partnerships in which the same persons own, directly or indirectly, more than 50% of the capital interests or profits interests.

- Any individual who is a parent, if the taxpayer is a minor, or minor son or daughter of the taxpayer.

Item 14 Estimated Expenditures and Microenterprise Tax Credits Computation Table

To be eligible to reserve tentative tax credits, the applicant must demonstrate that there will be new investment or employment in the microbusiness. The amounts in this table must be explained in the written response to item 9.

If a related person (see item 13) has also applied for tax credits for the same microbusiness and for the same period, the base year figures and the estimated growth of the microbusiness must be split accordingly and reflected in Table 14.

- Example 3

- Two equal partners apply and intend to equally share the microenterprise tax credits. In the base year, the microbusiness had $10,000 in investment for advertising. On each partner’s application, in Column A, $5,000 should be used as the base year's investment figure for advertising.

- Example 4

- Two equal partners apply and intend to equally share the microenterprise tax credits. The microbusiness anticipates purchases of $50,000 in new depreciable assets in Year 1. Each partner should enter $25,000 in Column B reflecting his or her share of the microbusiness's estimated investment. This same process continues for Year 2 and for the other categories reflecting the investment and employment in the microbusiness.

Base Year

- The base year is the year prior to the year of application. The base year investment and compensation activity must be established before tax credits can be calculated for growth in the year of application, and the year following application. Column A of the table in Item 13 must reflect the investment and compensation activities of the business in the base year.

- If an existing business is purchased in either the year prior to application, during the application year or the year following application, the base year information in Column A of Table 13 must reflect the total base year activities of the original business and the newly acquired business up to the date of acquisition. See GIL 29-17-3.

- If the microbusiness is under new ownership due to acquisition, a reorganization of an existing business, or due to the spin off of part of an existing business, the employment and investment of the business under the previously existing ownership or structure must be reported as base year investment and compensation in Column A if purchased during the base year.

Investment

- New investment means the increase in the current year over the year prior to the application in the total of the following costs incurred by the microbusiness:

- Original cost or the lease value of buildings and other depreciated assets;

- Repairs to and maintenance for property in Nebraska;

- Advertising; and

- Legal and professional fees.

Legal and professional fees are fees paid to individuals, such as certified public accountants, professional engineers, and attorneys for services related to the activities of the microbusiness. The purchase, lease, or repair and maintenance expenditures related to vehicles that are required to be licensed to operate on the streets and roads of Nebraska cannot be included in investment calculations.

Net Lease Increase

- Leasing a building or other depreciable property, excluding motor vehicles, may be included in calculating new investment. There is an increase in the value of leased property if the microbusiness has a new lease and there is an increase in the average net annual rent, even if it is not the first time the property has been leased. The increased investment is equal to the change in the annual lease costs multiplied by the term of the lease, not to exceed ten years. The lease is included as new investment in the year the control of the property is transferred to the microbusiness and the property is "placed in service," whether or not lease payments are due for the period during which control is transferred.

- Use the following Lease Calculation Worksheet to determine the value of the net annual lease increase. Include the amount of the lease increase from the worksheet in either Column B or D of Item 13 of the application:

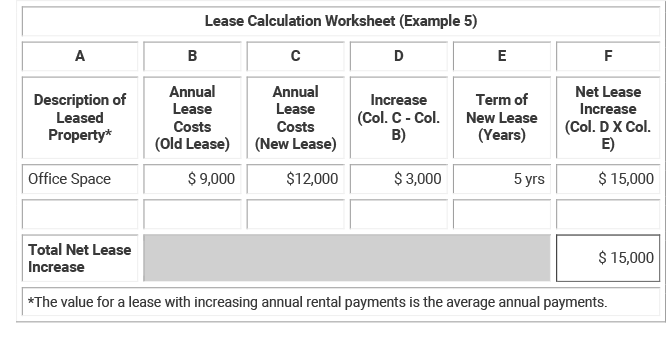

- Example 5

- The old lease for office space was an annual lease with $750/mo lease payments. A new lease for office space has a 60-month (5-year) term at $1,000/mo. Using the Lease Calculation Worksheet, the lease increase over the life of the new lease is $15,000 (see below):

Compensation

- New compensation means the increase in the total compensation (plus the employer cost for health insurance) for Nebraska resident employees in the current year as compared to the base year. New compensation does not include compensation paid to any employee with wages in excess of 150% of the Nebraska average weekly wage. The maximum wage level will be the same amount for all years in the application and is determined by the year of application. See Revenue Ruling 29-26-1 for the current maximum wage level. Compensation and the employer's cost of health insurance for an employee hired after the date of application can be included in the computation for the year of application and the year after application only if the newly hired person's authorization to work was timely confirmed by using E-Verify.

- Compensation does not include an amount paid to an employee leasing company for employee leasing or a professional employment organization (PEO).

Item 15

If not previously provided, enclose a copy of the most recent federal income tax return filed by the microbusiness. At a minimum, the federal income tax return should include copies of:

- First five pages of the business federal income tax returns;

- Consolidating schedules supporting the first five pages;

- Affiliations Schedule, Form 851;

- A copy of each Partner's or Shareholder’s Share of Income, Credits, Deductions, etc., Schedule K-1;

- Profit or Loss from Business, Schedule C;

- Profit or Loss from Farming, Schedule F; and

- Depreciation and Amortization, Form 4562.

If the microbusiness is new in the year of application and organized as a flow-through entity, attach a list of the owners, their ownership percentages, and their Social Security numbers.

Item 16

Indicate the payroll frequency and provide a copy of the most recent payroll register showing total hours paid to all employees for the pay period. If there are currently no employees, please indicate the date payroll is expected to begin. A microbusiness is a business with five or fewer FTE employees at the time of application.

- Example 6

- An applicant applies on January 4, and the microbusiness has a weekly payroll schedule. The payroll period, including January 4, cannot exceed 200 hours paid to employees (5 full-time equivalent employees x 40 hours per week) in order to meet eligibility requirements for the Act.

Note: The FTE calculation looks at the number of hours in a year. If DOR has reason to believe that the hours worked during the payroll period are not representative of the year, it may request payroll records for additional periods.

If the business currently does not have any employees, please indicate the date it expects to begin paying wages.

Item 17

Each microbusiness is required to be fully licensed according to the Nebraska licensing requirements listed on the Nebraska Tax Application, Form 20. Even if the microbusiness is not required to be licensed for sales tax, it must be licensed for use tax. Line 13 of the Form 20 relates to use tax.

The Form 20 can be submitted with your application.

Item 18

A net worth statement must be provided by any individual actively involved in a microbusiness that conducts farming or livestock operations.

The net worth statement must include all holdings of the applicant, spouse, and dependents. The statement must be based on the fair market value of assets net of any related debt. Types of assets to report on the net worth statement include, but are not limited to: land; equipment; livestock; grain; inventory; cash; investments; homes; and motor vehicles.

The net worth statement must be signed and dated by the applicant and a lawyer, banker, loan officer, financial counselor, or accountant, who gives his/her title and states in writing that the information provided on the statement appears to be accurate. The net worth statement must reflect the value of the applicant’s holdings as of the date of application. The net worth statement must be provided within 10 days after the date of application.

Signature

Part 1 of the application must be signed by the applicant actively involved in the microbusiness or by another person authorized to sign for the applicant by a power of attorney on file with DOR. Attach a copy of a completed Power of Attorney, Form 33.

Part 2 - Total Credits Reserved

DOR will confirm the total tentative tax credits reserved for an applicant by completing Part 2. A copy will be returned to the applicant.

If you have any questions regarding the preparation of the application, contact contact Taxpayer Assistance at 800-742-7474 (NE and IA), or 402-471-5729.

The application should be submitted using DOR's secure file sharing system here.

Applications filed electronically will receive email confirmation that the upload was successful.

III. Claiming the Microenterprise Tax Credit

To claim the credits, file a completed Nebraska Incentives Credit Computation, Form 3800N, and Nebraska Advantage Microenterprise Tax Credit Act Claim, Worksheet M, with the applicant's individual income tax return for the year of application and the year following application. Worksheet M is calculated with the actual increased investment and compensation, and must report accurate base year activity. You must provide a copy of the documents requested in Worksheet M to support your credit calculation. Documents supporting the claim may also be submitted using DOR's secure file sharing system. Omission of required documentation may result in a balance due notice due to the denial or reduction of the microenterprise credit.

The applicant must timely verify the work eligibility of all newly-hired Nebraska employees through the E-Verify system. Compensation paid to any employee who is not eligible to work in Nebraska, according to E-Verify must be excluded from the credit computation.

Electronic Filing

You may e-file your Form 1040N and include all substantiated documentation listed on the worksheet M as a PDF with your e-filed return. If your software does not support filing PDFs with your return, you may still e-file and claim the credit on Form 3800N. You may use DOR's secure file sharing system to upload the documentation after you file. If the documentation is not received you will be sent a letter and the return will not be processed until all documentation is received. DOR reserves the right to request additional documents and information as part of its review of the credit calculation. If you have any questions regarding how to properly file the required documentation with your individual income tax return, please contact Taxpayer Assistance at 800-742-7474 (NE and IA), or 402-471-5729.