Income Tax Withholding FAQs

This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. A guidance document does not include internal procedural documents that only affect the internal operations of DOR and does not impose additional requirements or penalties on regulated parties or include confidential information or rules and regulations made in accordance with the Administrative Procedure Act. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document.

This guidance document may change with updated information or added examples. DOR recommends you do not print this document. Instead, sign up for the subscription service at revenue.nebraska.gov to get updates on your topics of interest.

General Questions

-

Nebraska Department of Revenue (DOR): 800‑742‑7474 (NE & IA) or 402‑471‑5729

-

Nebraska Department of Labor (Unemployment Compensation): 402‑471‑9000

-

Nebraska Worker's Compensation Court: 800‑599‑5155 or 402‑471‑6468

-

Nebraska Secretary of State: 402‑471‑2554 or Corporate Division 402‑471‑4079

-

Internal Revenue Service (IRS): 800‑829‑1040

First, you need to apply for a Nebraska withholding number using the ![]() Nebraska Tax Application, Form 20, prior to withholding state income taxes from your employees. You will be mailed a Nebraska Withholding Certificate with your state identification number on it.

Nebraska Tax Application, Form 20, prior to withholding state income taxes from your employees. You will be mailed a Nebraska Withholding Certificate with your state identification number on it.

If you have a payroll service do your payroll, you are still responsible for filing this application before they can start any payroll activity. You should provide them with a copy of the Nebraska Withholding Certificate showing your state identification number and business name. This will allow them to prepare the returns they file for you with the correct Nebraska identification number. They are not authorized to file any returns for a Nebraska employer until they have received a Nebraska withholding identification number.

The Nebraska Circular EN has much more detailed information on Nebraska income tax withholding.

The rates, brackets, withholding allowance value, special withholding procedures, and withholding tables on wages are located in the Nebraska Circular EN.

The Employee’s Nebraska Withholding Allowance Certificate, Form W-4N, is the state equivalent to the Federal Form W-4. The Nebraska Form W-4N is completed by the employee to determine the number of allowances that the employer uses in conjunction with the Nebraska Circular EN to calculate the Nebraska income tax withholding. The value of the Nebraska allowance is listed in the Nebraska Circular EN.

Beginning January 1, 2020 the Nebraska Form W-4N is used to determine the correct Nebraska income tax withholding when the federal Form W-4 is completed on or after January 1, 2020. Employees who have completed the federal Form W-4 prior to January 1, 2020 are not required to submit a Nebraska Form W-4N and employers will continue to use the federal Form W-4 on file for Nebraska withholding purposes. For every 2020 federal Form W-4 employers receive, a Nebraska W-4N must be completed.

If an employee did not complete a federal Form W-4 prior to January 1, 2020 or beginning January 1, 2020 completes a federal Form W-4 but does not submit a Nebraska Form W-4N, employers must withhold at the single rate with no withholding allowances. The employer must use the single tables when the Nebraska Form W-4N has not been completed as required. The rates of 2.26% to 6.95% are dependent on the amount of wages and the single individuals tables should be used with no allowances regardless of marital status.

When an employee wants additional state income tax to be withheld, they complete line 2 on the Nebraska Form W-4N. Completing line 2 authorizes the employer to withhold an additional amount from each paycheck. The amount entered is in addition to the amount calculated based on the allowances.

Nebraska does not require payors to submit Form 1099‑MISC or other 1099 forms to DOR unless Nebraska state income tax withheld is to be reported. When Nebraska tax is withheld, the 1099 forms are submitted to DOR with the Nebraska Reconciliation of Income Tax Withheld, Form W‑3N. Several filing options are available including e-filing using the NebFile for Business program on DOR’s website and combined federal/state reporting. For more information, see the Nebraska Computer Reporting Procedure for 1099’s, 21CM.

Yes. The wages paid to employees for work done in Nebraska is subject to Nebraska income tax withholding. The only exceptions to this rule are wages paid to railroad crews, airline flight crews, and interstate truck drivers if the employee is a resident of a state other than Nebraska.

Through July 29, 2021, DOR will not require employers to change the state which was previously established in their payroll systems for income tax withholding purposes for employees who are telecommuting or temporarily relocated to a work location within or outside Nebraska due to the COVID-19 pandemic. A change in work location was not required beginning with the date the emergency was declared by Governor Pete Ricketts, March 13, 2020, and ending 30 days after the end of the emergency, which is July 30, 2021. Beginning on July 30, 2021, employers must review their payroll systems for income tax withholding purposes for employees working at a location that is in a different state to assure compliance with Nebraska requirements in 316 Neb. Admin. Code, Ch. 21 and Ch. 22, § 003.

Special 1.5% Withholding Procedures

Generally, if you employ 25 or more employees, withholding must be at least 1.5% of wages unless adequate supporting documentation of the number of allowances is provided by the employee.

Based on similar federal standards, if you employ 25 or more employees at any one time during the year, you are subject to the special withholding procedures. It does not matter how many W‑2s are actually issued during the tax year.

No, the special withholding procedures do not apply to any pension or annuity payments. While pension and annuity payments may be deemed “wages subject to withholding” under both federal and state law, the special 1.5% withholding procedures apply only to wages and salaries paid to active employees by their employer.

Generally, the special 1.5% withholding will be applied to an employee’s taxable wages. The term “tax qualified deductions” is not currently defined in either Federal or State law. Therefore, the Tax Commissioner has administratively defined tax qualified deductions to include tax‑deferred compensation, and other tax‑sheltered items (cafeteria plan benefits such as health insurance, retirement, medical and dependent care reimbursement, etc.).

The law specifies a withholding rate of 1.5%. However, the Tax Commissioner has set a threshold of 50% of a single person with one withholding allowance, or a married person with two allowances, as a minimum level of acceptable withholding. If withholding is imposed at this level (or greater), there will be no imposition of any employer penalty. You can also withhold an amount within the non‑shaded area of the withholding tables which may include: reducing the number of withholding allowances, or using the Percentage Method Tables to calculate at least 50% of the withholding for a single employee with one allowance or at least 50% of the withholding for a married employee with two allowances. This should result in a lower, but still adequate, withholding amount rather than calculating the withholding at the 1.5% level.

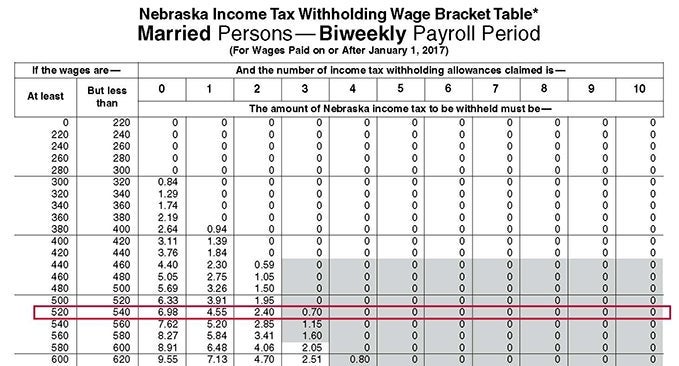

For instance, in the Married Biweekly withholding chart (a portion of which is reproduced below) assume an employee making $525 during the biweekly period has claimed 3 withholding allowances. The withholding from the withholding table for 3 allowances is $0.70. This amount falls within the shaded area of the table for the $520‑540 bracket and requires use of the special withholding procedures. Calculating the withholding at 1.5% would result in a withholding amount of $7.88 [$525 X .015], over 10 times the amount originally determined. Reducing the number of withholding allowances to 2 (for state purposes only) would set the withholding amount at $2.40, which falls within the non‑shaded area of the table. Using the Percentage Method Table, withholding would be calculated at 50% of the withholding for two allowances.

No, it is not necessary to keep such detailed or private information in the payroll files. Instead, you can develop a summary document that includes a statement signed by the employee that the employee’s Form W‑4 allowances have been reviewed and have been determined to be reasonable. A sample copy of this type of summary document is included in the link below.

![]() Employer Letter to Employees Regarding Special Withholding Procedures and Documentation Worksheet (Employers Note: You may print this document and photocopy for your own use)

Employer Letter to Employees Regarding Special Withholding Procedures and Documentation Worksheet (Employers Note: You may print this document and photocopy for your own use)

The following is a potential (but not complete) CHECKLIST for “adequate supporting documentation”:

- Mortgage interest – bank/mortgage firm year‑end statement

- Property tax on home‑ property tax statement from county treasurer (may be available online as public information)

- State income tax information – payroll statements or past Federal Forms W‑2.

- Charitable Contributions ‑ receipts from the employee's church or other charitable organizations

- # of Dependents ‑ social security cards, school registration, baptismal records

In addition, if the employer has benefits information in personnel or other records for the employee such as medical insurance with the number of dependents noted, this information may also be used.

The law specifies a withholding rate of 1.5%. However, the Tax Commissioner has set a threshold of 50% of a single person with one withholding allowance, or a married person with two allowances, as a minimum level of acceptable withholding. If withholding is imposed at this level (or greater), DOR will not impose any employer penalty.

The law specifies a withholding rate of 1.5%. However, the Tax Commissioner has set a threshold of 50% of a single person with one withholding allowance, or a married person with two allowances, as a minimum level of acceptable withholding. If withholding is imposed at this level (or greater), DOR will not impose any employer penalty. Because it may result in substantial over withholding, the single, no withholding level is not recommended.. Rather, you can set the withholding rate to a higher allowance number that will put the withholding into the non‑shaded area of the withholding tables. Also see the answers above.

Employers using the percentage method must compare the percentage method results with the payroll period tables to see if the calculated withholding percentage falls within the non‑shaded or shaded areas. The law specifies a withholding rate of 1½%. However, if the percentage method results fall within the required minimum acceptable withholding amounts as determined by the Tax Commissioner (non‑shaded area), you may use the percentage method withholding amount without fear of incurring any employer penalty.

If the percentage method results fall below the required minimum withholding amounts (shaded area), then the special withholding procedure must be used. You may accept documentation from the employee which justifies state withholding below the required minimum amount. If documentation is not received, then withholding must be calculated at some level within the non‑shaded area of the payroll period tables — either 1.5% of gross wages, less tax‑qualified deductions; or, if single, at 50% of the withholding for a Single employee with one allowance; or, if married, at 50% of the withholding for a Married employee with two allowances.

Because income tax withholding is an estimate of tax liability, and changes in wages or other circumstances can affect the withholding amount, DOR will not use the year‑end withholding against gross wages less qualified deductions as a threshold.

The Tax Commissioner may impose a penalty upon an employer who fails to either (a) withhold at least 1½% of the wages of any employee, or (b) obtain satisfactory evidence from the employee justifying a lower withholding amount as required by subdivision (1)(b) of Section 77‑2753.

If the employer is considering tips as wages, the tips will be subject to the same withholding requirements as all other wages that are paid.

According to Section 77‑2753(5), "Wages and other payments subject to withholding shall mean payments that are subject to withholding under the Internal Revenue Code of 1986 and are (a) payments made by employers to employees, except such payments subject to 26 U.S.C. 3406, (b) payments of gambling winnings, or (c) pension or annuity payments when the recipient has requested the payor to withhold from such payments."

Yes. You may e‑file current and prior year Forms W‑2, W‑2G, 1099‑MISC, or 1099R.

Forms W‑2 and 1099 must be e‑filed when an employer has over 50 Forms W‑2, 1099‑MISC, 1099‑R, or W‑2G to report.

Yes. All employers are encouraged to e‑file income tax withholding forms, even when not required.

All W‑2 and 1099 information must be reported on or before January 31 of the year following the reporting period. If January 31 falls on a weekend or holiday, the due date is extended to the next business day.

Yes. Your W‑2 file must contain the RV record. This record contains the State record totals.

Yes. Your identification number is found in the upper left‑hand corner of your Form W‑3N. Don't include the "21‑" or preceding "0s". Your login PIN is the 5‑digit number printed on your Form W‑3N and located above the signature block. You must enter your Nebraska state ID number and PIN to file over the internet.

An authorized owner or officer of the business may contact the Department. A ![]() Power of Attorney, Form 33 is required for individuals who aren’t authorized.

Power of Attorney, Form 33 is required for individuals who aren’t authorized.

You will be required to supply the contact person's first name, last name, email address, and phone number.

Yes. Payroll companies and other third parties filing Forms W‑2 and Forms 1099 for multiple taxpayers (bulk filing) may contact DOR to receive an ID and PIN that will give them access to the online filing program. To receive the ID and PIN, contact Taxpayer Assistance at 800‑742‑7474 (NE and IA) or 402‑471‑5729.

Yes. You may include multiple companies in one file if you have a bulk filing number. Do not file multiple companies under one of the company’s Nebraska state ID number. Make certain the data file submitted conforms to the proper format and includes all required records.

Nebraska only accepts Social Security Administrations EFW2 (Publication 42‑007) file format. The EFW2 file format is a fixed 512 record length record. W‑2 records must be exactly 512 characters long. Do not send other document formats. All files must contain the RA, RE, RW, and RS31 records. Please review Social Security Administration Publication No. 42‑007 EFW2 Tax Year 2013 for more information regarding file formats. Make sure that each data file submitted is complete (RA through RF Records). If your software does not allow you to create a file formatted as required if Publication 42‑007, review our instructions for using DOR’s W‑2 File Creator if your software does not create a file mentioned above. Review the Nebraska Computer Reporting Procedure, 21EFW2 information guide for DOR’s formatting and specifications.

Nebraska only accepts the federal formats and guidelines specified in IRS Publication 1220.

Nebraska will not accept PDF or CSV W‑2 or 1099 files. All magnetic media will not be processed. This includes diskettes and CDR media. DOR will accept paper W‑2s and 1099s.

The W‑2 file is posted via HTTPS to a web server and the data is protected with SSL level 3 256‑bit encryption.

You will be able to send both W‑2 and 1099 files. A file list will be created, and then all files may be submitted at once.

Yes. DOR has the ability to accept files larger than 50MB.

No. DOR will not accept password protected files.

You will receive a reference number that the file transfer was successful and the file was received. Print a copy of the reference number screen for your records.

DOR offers the Nebraska W‑2 File Creator spreadsheet which can be used by employers that do not have software to create a file in the required 21EFW2 format. You must have Microsoft Excel 2003 or newer to use this spreadsheet.

E-filing Form W‑3N, Nebraska Reconciliation of Income Tax Withheld

Yes. You may e‑file Form W‑3N, Nebraska Reconciliation of Income Tax Withheld. To access the e‑file system you must be issued a Nebraska Withholding ID number and PIN prior to December 15.

The Form W‑3N is due by January 31 of the year following the reporting period. If January 31 falls on a Saturday or Sunday, the return may be filed on the first business day after the due date.

The Form W‑3N online filing system will be available on January 3. You cannot file your Form W‑3N until you receive your paper form in the mail. If you previously e-filed, the return will no longer be mailed to you and you should review the previously e-filed return for the PIN. If you have not previously e-filed the form and have not received this form by January 10, please contact DOR.

No. Only the current year Form W‑3N may be filed online.

Yes. You will use your Nebraska Identification Number found in the upper left‑hand corner of your Form W‑3N. Do not include the “21‑” or preceding “0s.” Your PIN is the 5‑digit number printed in the lower left‑hand corner of your Form W‑3N.

An authorized owner or officer of the business may contact the Department. A ![]() Power of Attorney, Form 33 is required for individuals who aren’t authorized.

Power of Attorney, Form 33 is required for individuals who aren’t authorized.

From our home page, click on the“File/Pay your Return,” select “Income Tax Withholding E-file/Pay,” and log in to file the Form W-3N.

- Login using your company’s Nebraska ID Number. DO NOT INCLUDE THE INITIAL "21‑"

- Each withholding account is provided with a PIN, printed on the lower left‑hand corner of your Form W‑3N. Use this PIN for logging on to the secured website.

- Print a copy of your Form W‑3N for your records.

Successful filings will display a reference number. Be sure to print this notification for your records.

Yes. You must enter your fourth quarter amounton line 12 of the form.

You can remit a balance due in one of the following ways:

- Electronic Funds Withdrawal (EFW) schedules a payment when e-filing the Form W-3N. The reference number will include a “B,” which indicates the return was submitted and an electronic payment was scheduled.

- Electronically using our E‑Pay System.

- Initiating an ACH credit through your bank.

- With a credit card through ACI Payments, Inc. at 800‑272‑9829 or acipayonline.com. A convenience fee, based on the amount of tax being paid, is charged to the card you use. If initiating a credit card payment by telephone, you must provide the Nebraska Jurisdiction Code, which is 3700.

- Printing a voucher to remit payment by check.

*Be sure to file the Form W‑3N and report any wages and withholding.

After you have successfully completed filing, a reference number will be displayed. Print a copy of the reference number screen for your records.

No. You will not file a paper Form W‑3N.

The back and next buttons will allow you to navigate through the unfiled return. Required fields must have values entered. The system will automatically check your calculations.

Once the return has been submitted, you will need to amend your original filing by mailing a paper Form W‑3N with “amended return” written across the top of the form. Please include a written explanation of why you are amending the return.

Beginning with tax year 2017, DOR is no longer mailing the Nebraska Reconciliation of Income Tax Withheld, Form W-3N, to employers who e-filed the previous year Form W-3N.

Yes. Annual Form 941N filers will be able to file the Form W‑3N online. Remember, both Forms 941N and W‑3N must be filed.

Yes. Payroll companies and other third parties filing Forms W-3N for multiple taxpayers (bulk filing) may contact Taxpayer Assistance at 800-742-7474 (NE and IA) or 402-471-5729 for additional information to obtain an ID and PIN for the bulk filing W-3N program.

E-filing Form 941N, Nebraska Income Tax Withholding Return

If you are withholding Nebraska income tax, you must apply for a Nebraska ID number by submitting a ![]() Nebraska Tax Application, Form 20. Once your application has been processed, you will be provided with your Nebraska ID number and will automatically be set up to electronically file. Your Nebraska ID number will be used as your User ID on this filing system.

Nebraska Tax Application, Form 20. Once your application has been processed, you will be provided with your Nebraska ID number and will automatically be set up to electronically file. Your Nebraska ID number will be used as your User ID on this filing system.

Your Personal Identification Number (PIN) is printed under line 13 on the Nebraska Income Tax Withholding Return, Form 941N, which you will receive by mail. If you previously e-filed the return, the return will no longer be mailed. If you do not have a previous form with the PIN, you may contact Taxpayer Assistance at 800‑742‑7474 (NE and IA), or call 402‑471‑5729.

The e-file system is available for filing beginning the first week of the month following the close of the reporting period. You should verify that you are filing for the appropriate tax period on the website.

Yes. A current Nebraska Income Tax Withholding Return, Form 941N, remains warehoused on our website until the due date of the return. If an error is discovered, you can restart your return on the e-file system at any time through the due date. If the due date falls on a Saturday, Sunday, or legal holiday, the return or payment voucher may be filed on the first business day after the due date.

Yes. If you have a delinquent Form 941N, the return will remain available to e-file.

You can make a payment in one of the following ways:

- Electronic Funds Withdrawal (EFW), schedules a payment when e-filing the Form 941N. The reference number will include a “B,” which indicates the return was submitted and an electronic payment was scheduled.

- Electronically using our E‑Pay System.

- Nebraska

Tele‑pay, by calling 800‑232‑0057.

Tele‑pay, by calling 800‑232‑0057. - Initiating an ACH credit transaction through your bank.

- With a credit card through Official Payments at 800‑272‑9829 or on their web site: www.officialpayments.com. Official Payments will charge you a convenience fee, based on the amount of tax being paid.

- If not mandated to make your payment electronically, you can print a Nebraska Income Tax Withholding Payment Voucher to make your payment by check or money order.

See the Payment Options page for additional information.

The Tax Commissioner requires the use of electronic payments of taxes or fees for certain tax programs, including income tax withholding, if the taxpayer had made tax or fee payments above the designated threshold for that same tax program in a prior tax year. As of July 2017, the electronic payment threshold is $5,000. The electronic payment threshold changes annually on July 1. For a complete list of thresholds, click here.

A $100 penalty for non‑compliance with the mandate will be imposed for each non-electronic payment.

No. The paper returns are provided to you for record keeping purposes.

DOR will no longer mail the Form 941N to employers who e-filed the Form 941N previously. Paper filers will continue to be mailed the form.

Once you click the "File Return" button, the information is transmitted to DOR.

Regardless of which payment method you choose, if a tax due date falls on a weekend or a legal holiday, the timely filed date becomes the next business day. If you are scheduling your payment within the 941N program, you have until 11:59 p.m. on the timely filed date to schedule the payment. However, if you are using the ACH Debit option (Nebraska e-pay), you must complete your transaction before 5:00 p.m. Central Time on the timely filed date and indicate your settlement date to be the following day.

You are required to file your tax return showing zero liability.

The PDF remains available indefinitely, similar to saved returns in the sales tax e-file system. Once you have electronically submitted your Form 941N, the PDF of the return becomes available. You can access the e-file system anytime to view or print a previously filed return.

Yes. You will receive a paper return in the mail that will contain your User ID and PIN for e-filing. Future forms will no longer be mailed after a return is submitted electronically.

The Nebraska Monthly Withholding Deposit, Form 501N, serves as a payment voucher when submitting a paper payment. When electronically paying the deposit, the 501N is not mailed or e-filed.

After the due date any correction to the ![]() Nebraska Income Tax Withholding Return, Form 941N, should be made on line 3 of the next quarterly return (same calendar year). Once a

Nebraska Income Tax Withholding Return, Form 941N, should be made on line 3 of the next quarterly return (same calendar year). Once a ![]() Reconciliation of Nebraska Income Tax Withholding, Form W-3N, has been filed, any corrections to that tax year must be made on an

Reconciliation of Nebraska Income Tax Withholding, Form W-3N, has been filed, any corrections to that tax year must be made on an ![]() Amended Nebraska Reconciliation of Income Tax Withheld, Form W-3N.

Amended Nebraska Reconciliation of Income Tax Withheld, Form W-3N.

As with all taxes under this program, if there is a balance due on your amended return, you can make your amended tax payment using an electronic payment option; however, your amended return must still be mailed to DOR with the word "AMENDED" written or typed on the top of the Form 941N. It is acceptable to write "AMENDED" on the top copy of the e-filed return, and write the correct amounts next to the incorrect amounts.

No. Only returns for the current period or delinquent returns from prior periods that have not yet been filed can be filed via the e-file system. However, you can correct a return up until the due date for the tax period by using the 941N e-filing program. The option to correct your return is available on the Reference Page.

Further Questions?

Contact Nebraska Taxpayer Assistance

at 800-742-7474 (NE & IA) or 402-471-5729