Frequently Asked Questions about Filing the Nebraska Litter Fee Return Online

This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. A guidance document does not include internal procedural documents that only affect the internal operations of the DOR and does not impose additional requirements or penalties on regulated parties or include confidential information or rules and regulations made in accordance with the Administrative Procedure Act. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document.

This guidance document may change with updated information or added examples. DOR recommends you do not print this document. Instead, sign up for the subscription service at revenue.nebraska.gov to get updates on your topics of interest.

You can use any of the following web browsers:

- Google Chrome Version 30 or higher;

- Mozilla Firefox Version 27 or higher;

- Microsoft Edge – any; or

- Opera Version 12.18 or higher.

No, provided you have a Nebraska Litter Fee license. If you are licensed for Nebraska Litter Fee there is no registration necessary to use the online filing system. Businesses without a Litter Fee license who have an existing Nebraska ID number for any current tax program, will use the Nebraska Tax Application, Form 20, to obtain a license for the Nebraska Litter Fee program. Businesses without an existing Nebraska ID number for any current tax program may obtain a Litter Fee license by going to Register Your New Business Online.

The system is open for filing on September 9 of each year.

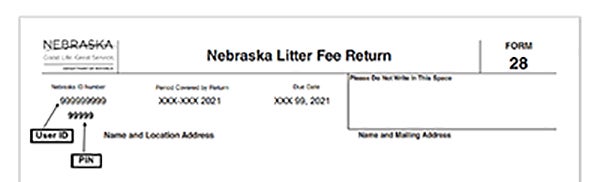

If you received a paper Nebraska Litter Fee Return, Form 28, in the mail, you will use the Nebraska ID number (User ID) and 5-digit PIN found on the paper return. Filers who did not receive a paper return will use the same Nebraska ID number (User ID) and 5-digit PIN used to log in and file the Nebraska online sales tax return. If you cannot find your User ID and PIN, you may contact Taxpayer Assistance at 800-742-7474 (NE and IA) or 402-471-5729.

Yes, a "zero" return must be filed by the due date, even if there is no fee due.

The preferred method to pay your liability is via Electronic Funds Withdrawal (EFW) when filing your return online. If you choose not to pay by EFW, you may use ACH Credit, Nebraska e-pay (EFT Debit), Nebraska Tele-pay, or pay by check. When paying by check, you must print the payment voucher available through the link on the reference page of the online return, and mail with your check. Refer to DOR’s website for payment options.

When paying by EFW, your return and payment must be submitted before midnight on the due date. Payments made by ACH Credit must have an effective date equal to the due date or sooner. If using e-pay or tele-pay the payment must be completed by 5:00 p.m. Central Time on the last timely filed date.

Click “Create PDF to Print or Save” on the reference page at the completion of your filing. If you would like to obtain a copy after the due date of your return you may login to the Litter Fee return and select the year that your return was filed under the View, Print, or Save Filed Returns section.

If you discover a mistake prior to the due date you may restart your online return and correct the mistake. If you restart your return you must click on File Return and receive a new reference number. When a mistake is discovered after the due date you must file an amended return by completing a paper Form 28, write “amended” at the top, write the reason for amending below line 3, and mail it to the address at the bottom of the form.

You may send a signed letter requesting a refund that includes the business name, Nebraska ID number, the amount of the refund, and attach it to the amended return.

No. Online filers will not receive a Form 28 in the mail.

If you receive a reference number, your return has been filed.

You may make an online payment for the additional fee due by using ACH Credit, Nebraska e-pay (EFT Debit), or Nebraska Tele-pay. Refer to DOR’s website for payment options. If using e-pay or tele-pay the payment must be completed by 5:00 p.m. Central Time on the due date to avoid penalty and interest. If you would like to pay by paper check you may print the voucher and mail to the mailing address at the bottom.

The penalty is $25, or 10% of the tax, whichever is greater, and interest is assessed at the rate specified in Section 45-104.02 from the due date until the date payment is received.

Yes. You may log in to the online return. On the Tax Period page, in the “Select a Return to File:” drop down box, one of the following three messages will display for the tax period:

- 6/2021 (Annual) – Return not filed: Due 10/01/2021

- 6/2021 (Annual) – Started return, not submitted: Due 10/01/2021

- 6/2021 (Annual) – Return submitted, warehoused until: Due 10/01/2021

If you are confirming your filing prior to the due date you will see the message “6/2021 (Annual) – Return submitted, warehoused until: Due 10/01/2021.” Select “Save Next” to obtain your reference number and the status of your payment.

If you are confirming your filing after the due date select the current tax year below “View, Print and Save Filed Returns,” then select the tax period to obtain a copy of your reference number and payment status.

If you see the wording in the first or second bullet point your return has not been filed. You must complete the return and click “File Return” to obtain your reference number and payment status.

No. Nebraska does not accept PDFs of the Nebraska Litter Fee Return, Form 28.

You must file a Nebraska Change Request, Form 22, to update the location address of a business. The mailing address can be updated during the filing of the online litter fee return.

You must click “File Return” on the filing Summary page for your return to be filed and the filing status to update.

You must file a Nebraska Tax Application, Form 20 to license the location for litter fee and a Nebraska Combined Filing Application, Form 11, to add the location to the “combined” Nebraska litter fee ID number. All locations filing under the combined return must have common ownership. “Common ownership” means the same person or persons own at least 80% of each licensed location. If the unlicensed location does not get added to the combined litter fee return, it must file a separate return.