Online Sales and Use Tax Filing FAQs

This guidance document is advisory in nature but is binding on the Nebraska Department of Revenue (DOR) until amended. A guidance document does not include internal procedural documents that only affect the internal operations of DOR and does not impose additional requirements or penalties on regulated parties or include confidential information or rules and regulations made in accordance with the Administrative Procedure Act. If you believe that this guidance document imposes additional requirements or penalties on regulated parties, you may request a review of the document.

This guidance document may change with updated information or added examples. DOR recommends you do not print this document. Instead, sign up for the subscription service at revenue.nebraska.gov to get updates on your topics of interest.

Recommended browsers for accessing the Nebraska Department of Revenue online filing systems:

-

Google Chrome

-

Microsoft Edge

-

Mozilla Firefox

-

Apple Safari

No. All sales and use tax filers are eligible to file online.

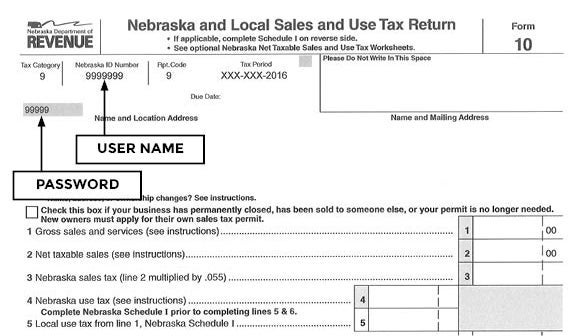

No. There is no registration necessary to use this program. Your Nebraska ID Number (User Name) and password are printed on your Form 10 and allow you access into the system.

The system is available for filing beginning the first day of the month following the close of the tax period. You should verify that you are filing for the appropriate tax period on the Web page.

The preferred method to pay your liability is via Electronic Funds Withdrawal (EFW). Your return and payment must be submitted before midnight on the last timely filed date to avoid penalties.

If using e-pay, the payment must be completed by 5:00 p.m. Central Time on the last timely filed date.

No. If you make a mistake and submit incorrect information, you should shut down your browser. Your progress will be saved and you can continue filing your return by logging back into the filing system.

You can either view or print a copy of a filed return from the initial screen after selecting to File Form 10.

No. Amended returns can only be filed using a paper amended return.

You will not receive Form 10 in the mail if you have been mandated to file and pay electronically, nor will you receive Form 10 once you file electronically.

There is currently not an Internet filing option for lodging tax, but DOR is constantly analyzing the possibility of new filing options.

If you receive a reference number, your return has been submitted.

Yes. Schedule II information must be completed for each Location ID.

Enter a zero in any column not having a dollar amount.

Once the Submit button is clicked on the Nebraska and Local Sales and Use Tax Return, Form 10, the information from all schedules and the Form 10 is sent to DOR.

After South Dakota v. Wayfair, if you are making sales of property or services into other states, you may have an obligation to collect and remit those states’ sales taxes. If you are licensed to collect and remit tax in Nebraska, you should continue doing so. You can obtain information on the licensing requirements for other states at: taxadmin.org. You can register with 23 other states using the Streamlined Sales Tax Registration System (SSTRS) registration form, which is available at: sstregister.org

If you make purchases of property or services from online retailers or retailers located in other states that have not previously collected sales tax, many of these retailers will now begin collecting the applicable sales tax on your purchases delivered into Nebraska. If any purchases are not taxed appropriately, you still have a responsibility to report the applicable use tax directly to DOR on these purchases.